Business, including business in the PET industry as well, is obviously strongly dependent on the long term attitude of the investors towards market development and it’s ability to generate profits. Detailed observations of the Polish economy and politics might give in fact a much more positive picture than what is nowadays being reported in the news throughout Europe.

REGIONAL PROCESSES

It has been over 28 years now, since the fall of communism in Eastern Europe and the reestablishment of market driven economies throughout the region. One must notice, that at the initial stage, the ruined and inefficient industries in combination with the frequently corrupted leaders, have been an easy catch for large international players, allowing them to takeover major banks, energy providers and key industry sectors. The local investors had to slowly fight their way through the barriers of bureaucracy, bribery, lacks in technologies and know-how.

With a population of 38 million people (#6 in the EU) and the GDP rate per capita growing from 1,700 USD in year 1990 to almost 13,000 US dollars in 2017, Poland has a fairly strong market of consumers, especially when comparing it to other Central Eastern European countries. Maintaining its own currency - the Polish zloty, despite all pressure from the EU to change to the Euro, limits the risks of external threats and fluctuations influencing the Polish economy.

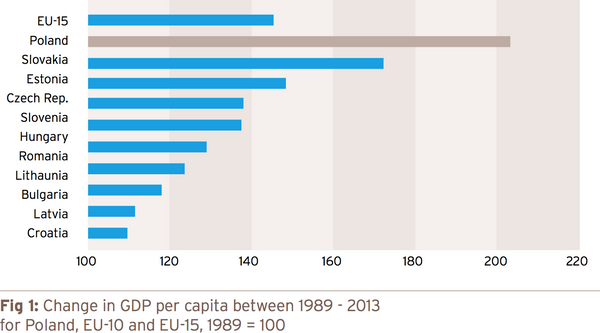

The above factors have turned out to be significant during the global crisis of 2009, helping Poland to keep the GDP positive – through a high internal consumption and through increased exports, driven by the lower exchange value of the zloty. Not to underestimate in further development trends, were the EU funds, used in conjunction with local assets to modernize multiple private and state-owned businesses and the infrastructure.

CURRENT TRENDS

Indeed, in late 2015 a major switch took place in Polish politics,

which has lead and continues to lead to short- and long-term effects in the economy. A negative impact has been observed in the overall rate of investments, as the local and international players had to get acquainted with the new situation. Over the last 2 years though, changes have been introduced that effectively limited corruption, increased the efficiency of tax collection and improved the average standard of life. Not to be omitted, the social benefits, meant to increase the birth-rate in the long term, have boosted consumption by increasing the “purchasing power” of millions of households.

Thus, in 2017 alone, the salaries grew in average by 5-7%, with an inflation rate at 2,5%, unemployment dropping to a record low of 6,5% and the general GDP growth at 4%. The budgetary incomes of the state increased by 15% in one year (!) mainly through the growing corporate and personal revenues and stopping illegal VAT manipulations.

The current conflict of the Polish government with the EU Commission including the apparent accusations of Poland breaching European values, it’s own constitution and the rule of law, seem in reality to be bound more to political and financial battles on influence, rather than based on true arguments. Still, escalating the conflict might eventually pose a threat to the stability of the economy and further EU funds being utilized in Poland. One most note though, that the slower development in Poland would turn to be a huge problem to the western investors and suppliers of modern solutions, incl. machinery, as over 80% of the EU funds are eventually “making their way back to the West” through purchases of technology, service, management and consulting.

After the recent meeting of Jean Claude Juncker with the Polish PM Mateusz Morawiecki, an agreement seems to be the most likely outcome. Regardless of that, the World Bank and the International Monetary Fund have increased their expected growth rates for Poland in 2018. Local governmental plans, including the to-come “Constitution for business” should create even a more business friendly environment for entrepreneurs and generally a better ground for sustainable growth.

On the other hand, a challenge mentioned nowadays by a number of Polish managers of businesses is that qualified workforce becomes more difficult to find. The <3% unemployment rate in the industrial zones is a fact, not undermined by the presence of over 1million immigrants from the Ukraine. Noticeable though, that low unemployment leads eventually to needs of automation and digitalization – thus progressing into Industry 4.0. According to the data of Siemens Finance, the digital revolution in Poland can bring in the coming years over 1 billion dollars profit to the Plastics sector.

PET PACKAGING

Indeed, one can observe the constantly growing interest in new technologies within the packaging industry. Polish PET converters are paying increasing

attention to the quality of preforms and bottles, implementing new production lines and some of the newest means of measuring the output, efficiency and product quality. Immediate feedback is used to ensure or even exceed standards – frequently using closed-loop automation. A good example here are the AGR Process Pilot systems, helping to manage quality and lightweighting of PET bottle blowing at the remarkable facility of the Naleczow Zdroj water plant.

The Polish PET market in the beverage industry has no dominating players. Certainly the preform producers, like Alpla, WiP or Hanex find competition only in foreign suppliers, mainly Retal, but the bottle blowing converters and fillers have no major leaders. The key market players include affiliates of Danone (Zywec Zdrój), Coca-Cola, Nestle, Pepsico and San Benedetto, but also the private owned Naleczow Zdrój (Cisowianka), Maspex, Zbyszko, Hanex, BEWA, etc. The competitive battles result in better products, more intensive marketing campaigns and interesting sponsorship programs.

Interestingly enough, there are no high output blowing machines on the Polish market, with speeds exceeding 50,000bph. Most lines are meant to be universal, ready for job changes, and efficient use, based on the monitored needs of the market.

Plastic packaging generates almost 50% of the Polish packaging revenues overall. PET bottles hold an app. 60% share of total unit volume sales of soft drinks. Poland is anticipating a CAGR (compound annual growth rate) of 4.4% for drinks bottled in PET over the four-year period from 2016 to 2020, with glass and can forecast to grow respectively by 2.7% and by 1.0% over the same period. Sales of bottled water reached1,5 billion EUR in 2017 with a prediction of growth to 1.8 billion EUR estimated in 2020.

CONCLUSION

Welcome to the land of development.

The comPETence center provides your organisation with a dynamic, cost effective way to promote your products and services.

magazine

Find our premium articles, interviews, reports and more

in 3 issues in 2026.